50.0

17.4

32.6

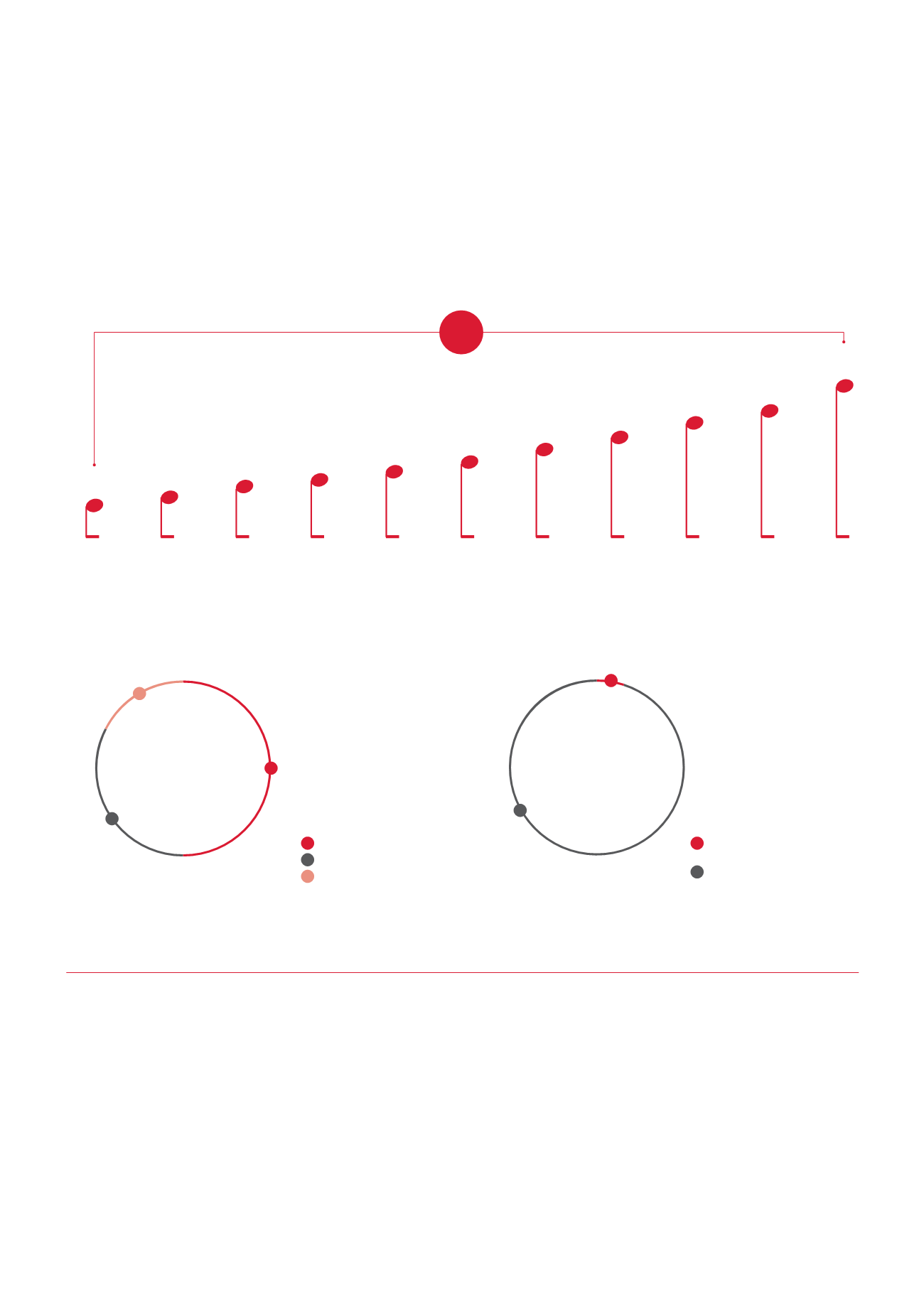

Sectoral Breakdown of Total Shareholders’ Equity

(%)

4.9

95.1

Position in the Finance Sector

(%)

2006

2008

2010

2012

2007

2009

2011

2013

2015

2016

2014

3,979

4,772

5,806

6,391

7,262

8,160

9,374

10,574

11,928

13,237

15,590

15%

CAGR

Total Shareholders’ Equity of the Financial Leasing, Factoring, Financing Sectors

(TL million)

TL 15,590 million

In 2015, total shareholders’ equity of the three

sectors grew 17.9% year-on-year and reached

TL 15,590 million, whereas return on equity rose to

13.5% in 2016.

15%

Total shareholders’ equity of the sectors increased

by 15% on average from 2006 to 2016. In terms of

shareholders’ equity, the three sectors constitute

4.9% of the Turkish finance industry.

Total (Financial Leasing,

Factoring, Financing)

Banking Sector

Financial Leasing

Factoring

Financing

The Association of Financial Institutions

Annual Report 2016

25