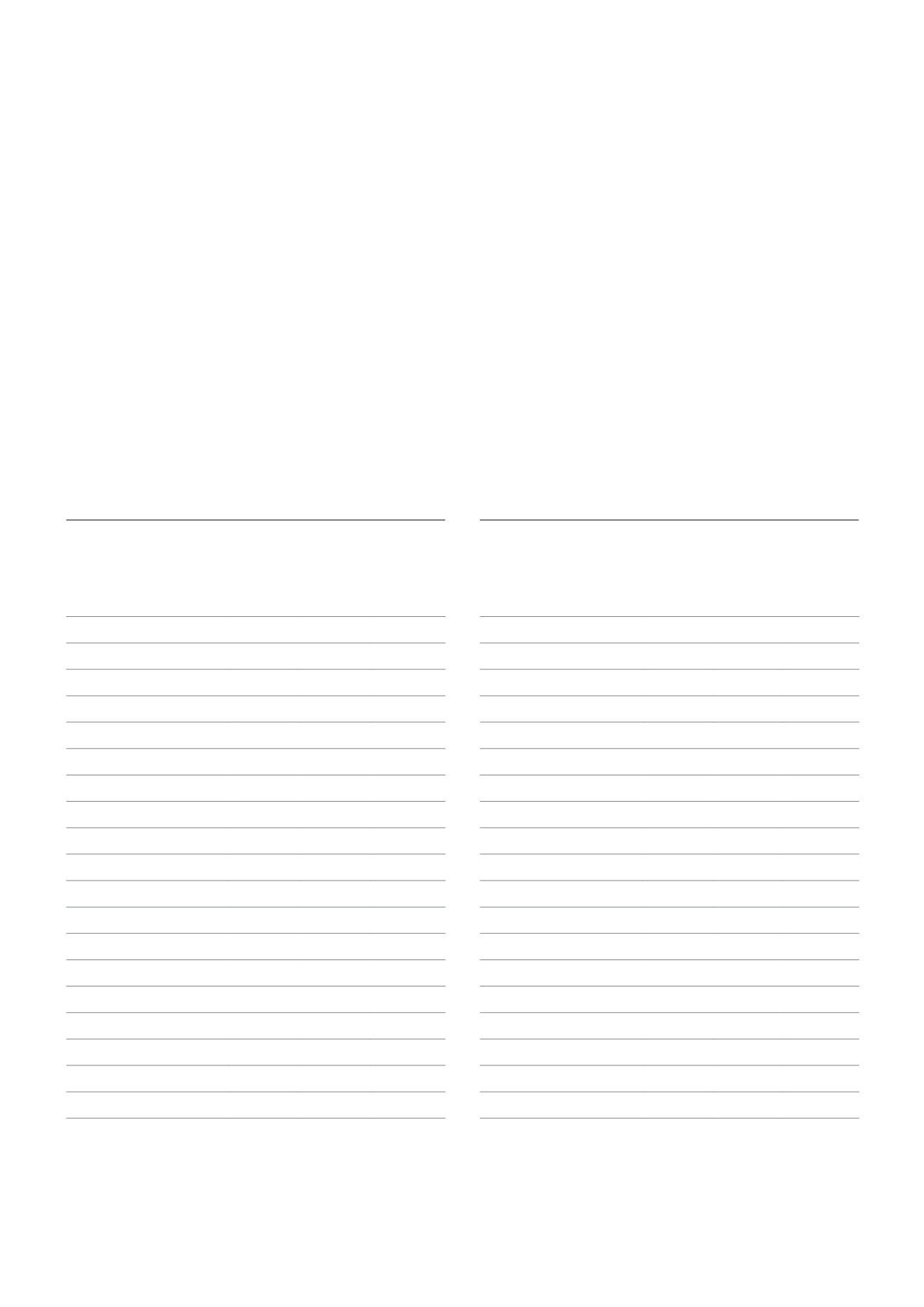

Financial Leasing

(TL million)

2016 2015 % Change

Transaction Volume

18,620 17,312

7.60%

Total Assets

48,500 40,656 19.30%

Receivables

44,022 36,718 19.90%

NPL

2,939

2,355 24.80%

Special Provisions (-)

1,818

1,488 22.20%

Shareholders’ Equity

7,800

6,930 12.60%

Borrowings

31,244 27,237 14.70%

Net Profit

922

809 14.00%

(units)

Number of Companies

26

28 -7.10%

Number of Branches

141

143 -1.40%

Number of Employees

1,519

1,504

1.00%

Number of Customers

58,373 56,396

3.50%

Return on Equity

12.50% 12.40% 0.1 pps

Return on Assets

2.10% 2.20% -0.1 pps

NPL Ratio

6.30% 6.00% 0.2 pps

Factoring

(TL million)

2016 2015 % Change

Transaction Volume

122,761 119,652

2.60%

Total Assets

33,090 26,685 24.00%

Receivables

31,027 24,984 24.20%

NPL

1,521

1,467

3.70%

Special Provisions (-)

1,299

1,196

8.60%

Shareholders’ Equity

5,085

4,587 10.90%

Borrowings

23,502 18,011 30.50%

Net Profit

665

387 71.80%

(units)

Number of Companies

62

66 -6.10%

Number of Branches

360

379 -5.00%

Number of Employees

4,716

4,804 -1.80%

Number of Customers

98,908 95,416

3.70%

Return on Equity

13.70% 8.60% 5.2 pps

Return on Assets

2.20% 1.50% 0.8 pps

NPL Ratio

4.70% 5.50% -0.9 pps

Financial Indicators

TL 18,620 million

As of year-end 2016, total business volume of

financial leasing companies grew by 7.6% year-over-

year to TL 18,620 million. While heavy-duty and

construction machinery got the biggest share out of

total financial leasing receivables with 25.1%, real

estate accounted for 24.2%. The sector is projected

to grow by 15% in 2017.

TL 122,761 million

Total business volume of factoring companies was

up by 2.6% to TL 122,761 million in the twelve

months to end-2016. Domestic and international

factoring transactions made up 82.5% and 17.5% of

the total business volume, respectively. The sector’s

anticipated growth is 10% for 2017.

Annual Report 2016

The Association of Financial Institutions

18