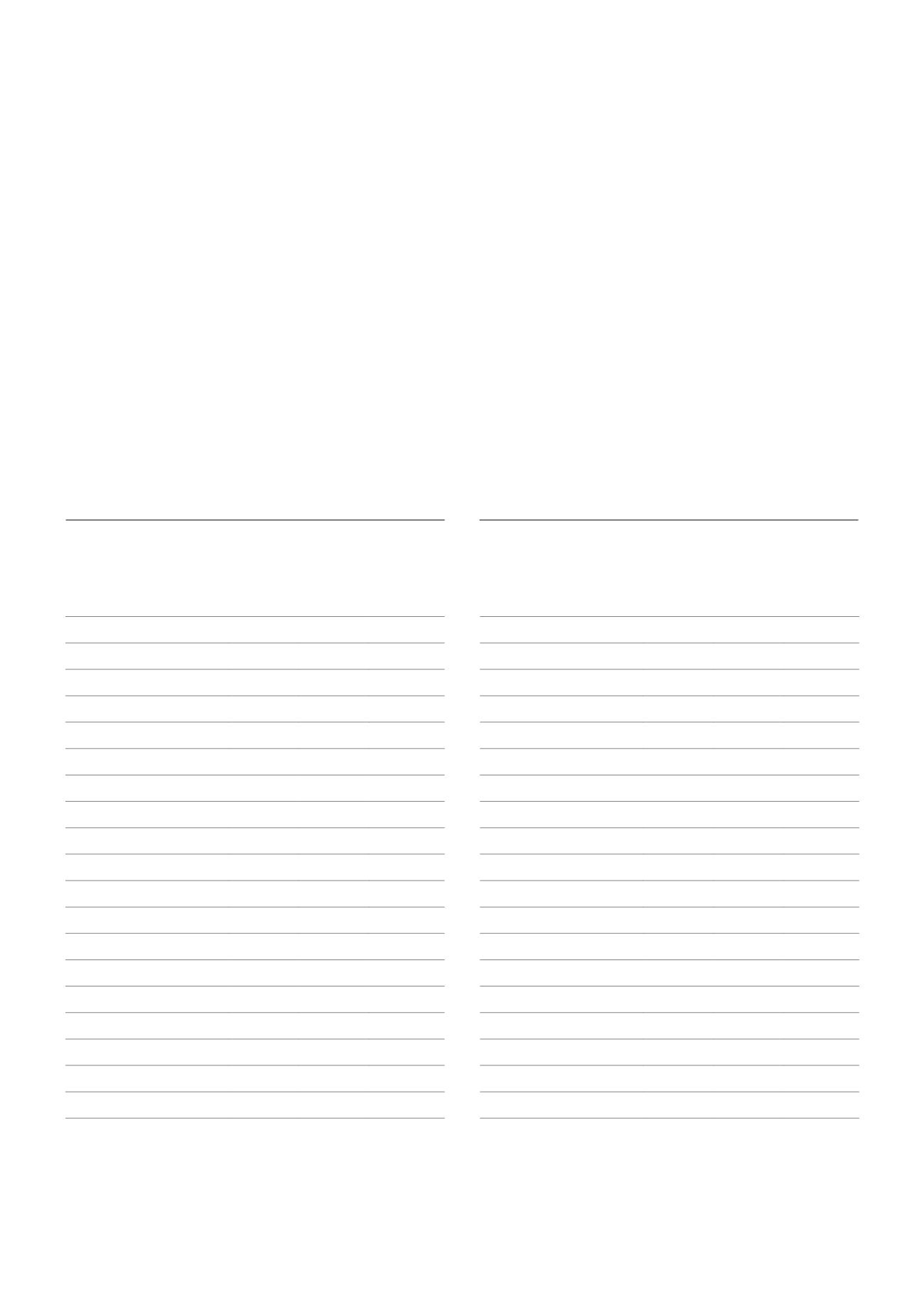

Financing

(TL million)

2016 2015 % Change

Transaction Volume

22,186 19,100 16.20%

Total Assets

32,798 27,220 20.50%

Receivables

27,855 23,825 16.90%

NPL

937

730 28.30%

Special Provisions (-)

425

325 30.80%

Shareholders’ Equity

2,705

1,701 59.10%

Borrowings

25,535 22,023 16.00%

Net Profit

358

356

0.70%

(units)

Number of Companies

14

12 16.70%

Number of Branches

0

2 -100.00%

Number of Employees

869

827

5.10%

Number of Customers

2,439,186 613,049 297.90%

Return on Equity

16.30% 23.00% -6.7 pps

Return on Assets

1.20% 1.50% -0.3 pps

NPL Ratio

3.30% 3.00% 0.3 pps

Total

(TL million)

2016 2015 % Change

Transaction Volume

163,567 156,064

4.80%

Total Assets

114,388 94,560 21.00%

Receivables

102,903 85,527 20.30%

NPL

5,398

4,553 18.60%

Special Provisions (-)

3,542

3,009 17.70%

Shareholders’ Equity

15,590 13,218 17.90%

Borrowings

80,282 67,270 19.30%

Net Profit

1,945

1,551 25.40%

(units)

Number of Companies

102

106 -3.80%

Number of Branches

501

524 -4.40%

Number of Employees

7,104

7,135 -0.40%

Number of Customers

2,596,467 764,861 239.50%

Return on Equity

13.50% 12.30% 1.2 pps

Return on Assets

1.90% 1.80% 0.1 pps

NPL Ratio

5.00% 5.10% -0.1 pps

TL 22,186 million

Total business volume of financing companies, which

increased 16.2% year-on-year, rose to TL 22,186

million in 2015. 98% of the new loans extended

during 2015 consisted of personal and corporate

auto loans. The sector is predicted to expand by 20%

in 2017.

TL 163,567 million

The aggregate business volume of financial leasing,

factoring and financing companies increased to

TL 163,567 million in 2016, translating into a year-on

growth of 4.8%.

The Association of Financial Institutions

Annual Report 2016

19