Japan will continue to underperform its medium-term inflation

target for yet some time to come. Owing to uncertainties over

British-EU relationships in the post-Brexit landscape and the

resulting weakness in the pound, it is forecast that inflation in

the UK will fall below the 2% target set for 2017 and 2018 but

that it may achieve it in the years that follow.

Although developing countries’ capital markets generated

higher yields in 2016, there were some improvements to be

seen in those of developed countries.

According to figures published by the World Federation of

Exchanges, the aggregate market value of the world’s capital

markets amounted to USD 67.1 trillion as of end-2015; in the

twelve months to end-2016, that figure slipped slightly to

USD 65.9 trillion.

Looking at market value on a regional basis we see that US

exchanges were the best performers with their combined

market value increasing by 10.8% year-on to USD 31 trillion in

2016.

Exchanges in the Asia-Pacific region by contrast saw their

combined market value fall by 18.5% to USD 18.9 trillion.

European, African, and Middle East markets registered a barely

perceptible 0.5% rise year-on and amounted to USD 16.9

trillion in value.

The exchange that registered the highest twelve-month

increase in its market value on a percentage basis was the

Belarus Currency & Stock Exchange, whose market value shot

up by 132% to USD 1.2 billion last year. That was followed

in quick succession by TROP-X (Seychelles) with the Moscow

Exchange and BM&F BOVESPA (Sao Paulo) coming in a

distant third and fourth place with rises of 61.7% and 57.8%

respectively.

The exchange which suffered the biggest twelve-month

percentage loss was Nigeria’s, which saw its market value

plummet by 42.2% from USD 50 billion in December 2015 to

USD 28.9 billion in December 2016.

The Nigerian Stock Exchange was followed by the nearly equally

dismally-performing Egyptian Exchange (down 41.8% year-on).

Coming in third and fourth places were the Ukrainian Exchange

(down 22.1%) and Borsa İstanbul, whose market value fell by

16.5% to USD 157.7 billion.

Long the world’s biggest stock exchange in terms of total

market capitalization, the New York Stock Exchange easily

maintained that standing in 2016. The market capitalization of

its listed companies, which amounted to about USD 17.8 trillion

at end-2015, increased by 10% to USD 19.6 trillion over the

next twelve months.

NASDAQ OMX saw its aggregate market value increase by 6.8%

to USD 7.8 trillion in the twelve months to end-2016 while the

market capitalization of the Japan Exchange Group increased

by 3.4% to USD 5.6 trillion during the same period.

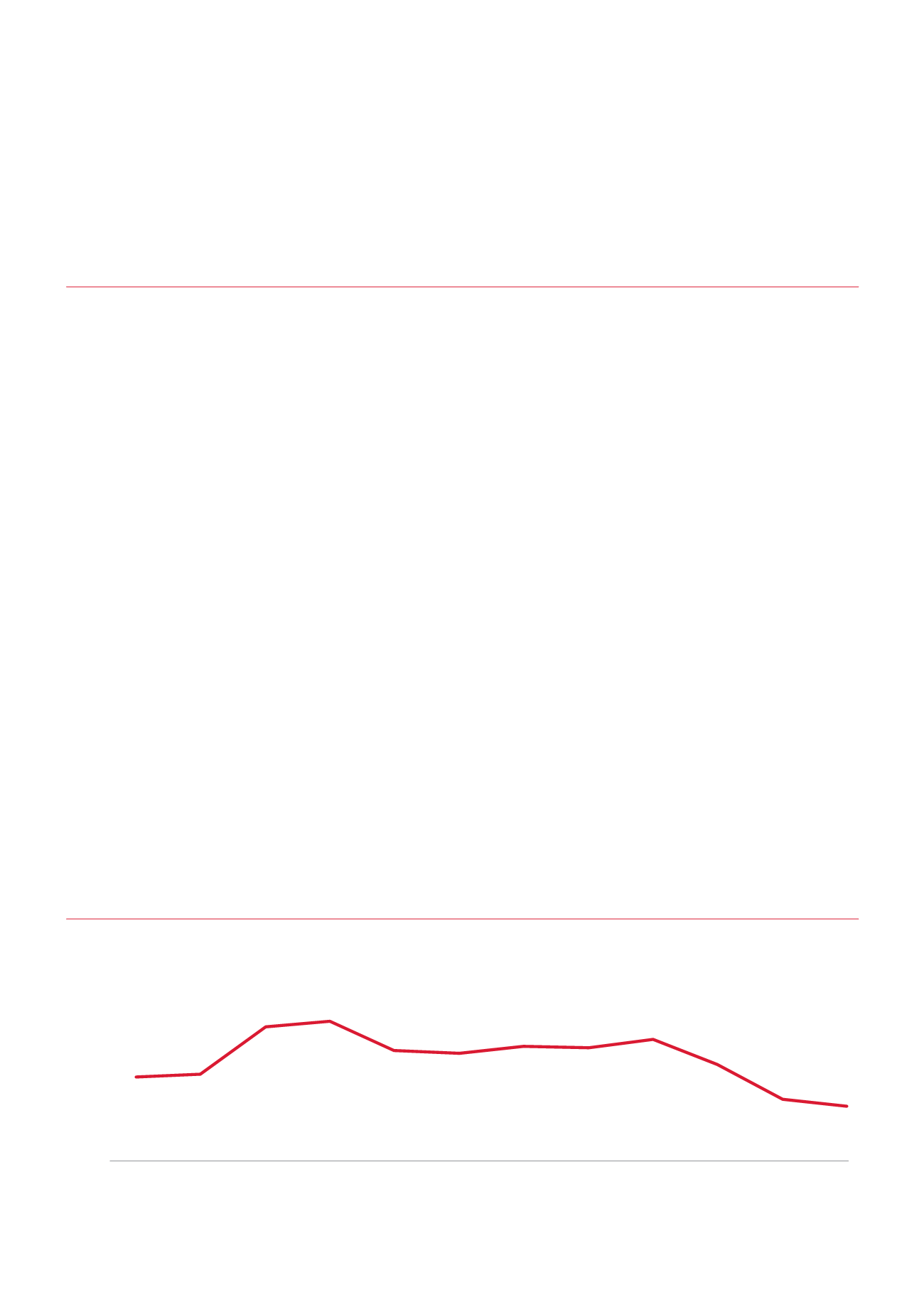

EUR/USD Parity

01/2016

02/2016

03/2016

04/2016

05/2016

06/2016

07/2016

08/2016

09/2016

10/2016

11/2016

12/2016

1.1600

1.1400

1.1200

1.1000

1.0800

1.0600

1.0400

1.0200

1.0000

The Association of Financial Institutions

Annual Report 2016

35