2016 AFI operations

management. In February 2014, AFI decided to work with the

Credit Bureau of Turkey on the design and composition of

CIRS’s software infrastructure.

Created in collaboration with the Credit Bureau of Turkey as a

project to protect factoring companies and banks against the

potential harm caused by duplicate invoicing and financing in

the conduct of their vitally important trade-finance operations,

CIRS became operational in 2015. As of end-2016, the system

was being used by 17 banks and 61 factoring companies.

As a first step, invoices and similar documents related to the

assignment of commercial receivables began to be fed into the

system. The immediate effect of this was to spot the duplicate

assignment of a quarter of a million documents (65 thousand

in 2016 alone) and prevent the fraud they would have led to.

Major projects and developments

Central Invoice Recording System

The Central Invoice Recording System (CIRS) is a system that

has been created to aggregate all information and documents

pertaining to factoring receivables so as both to prevent the

same receivable from being assigned more than once and to

provide a means to monitor and report factoring-industry data.

The Association of Financial Institutions (AFI) was given the

duty of setting up this system under article 43 of the Leasing,

Factoring, and Financing Companies Act (Law no: 6361), which

went into effect with its publication in the official gazette on

13 December 2012.

As per that mandate as well as that of applicable articles of

AFI’s charter that went into effect with their publication in the

official gazette on 25 July 2013, AFI began working on CIRS.

As a first step, a separate subsidiary to be in charge of the

project was set up within the Association and the Factoring

Sector Representatives Board was given responsibility for its

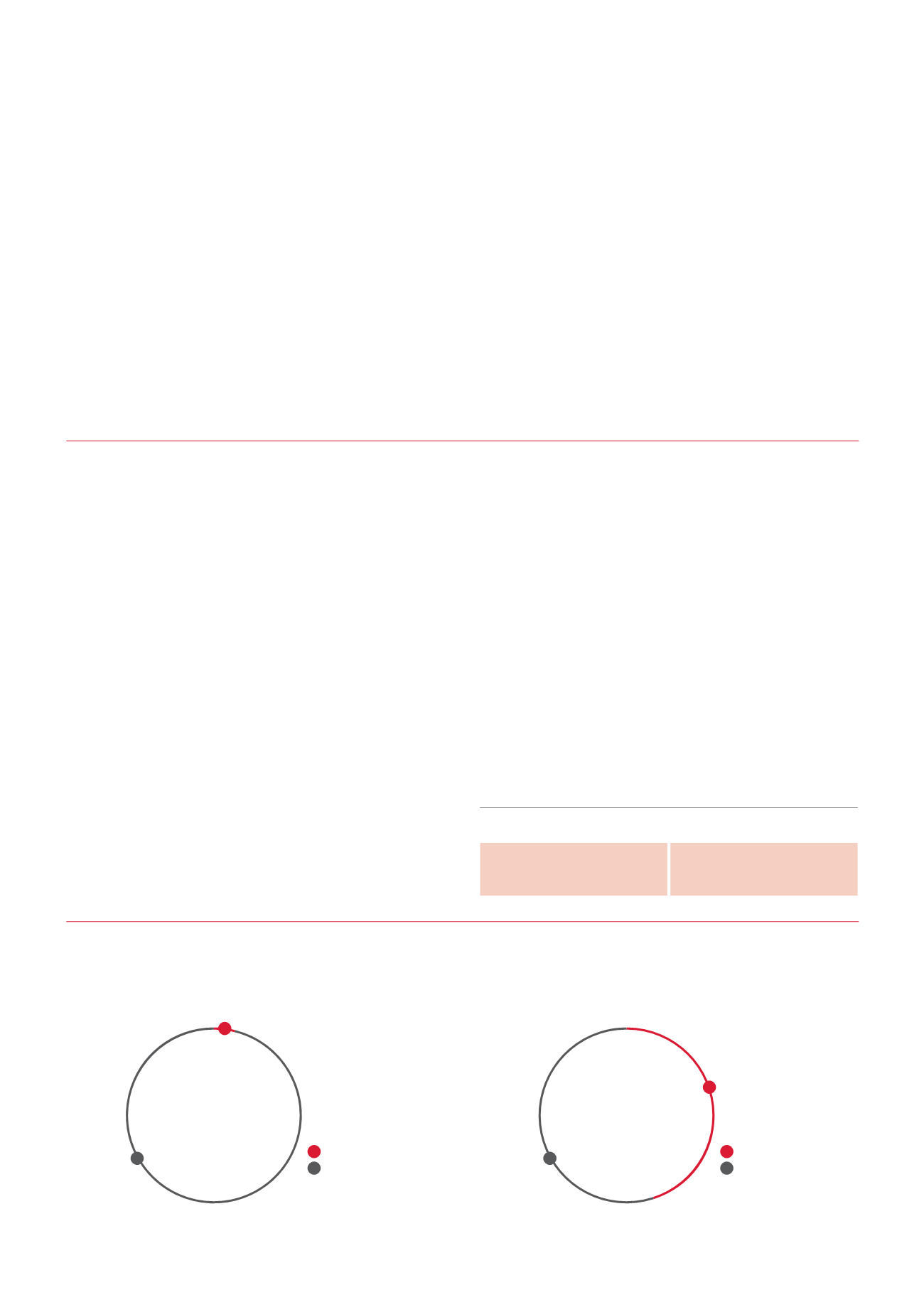

Central Invoice Recording System

The Central Invoice Recording System, a project undertaken by the Association of Financial Institutions in

partnership with the Credit Bureau of Turkey to protect factoring companies and banks against the potential

harm caused by duplicate invoicing and financing in the conduct of their vitally important trade-finance

operations, has been operating effectively since 2015.

2016 # of Transfers

(Type of Business)

2,601,912

45%

238,072

4%

3,183,378

55%

5,547,218

96%

E‑invoice

Hard copy

Bank

Factoring

2016 # of Transfers

(Type of Document)

# of Risky Transactions

2015

185,000

2016

65,000

Annual Report 2016

The Association of Financial Institutions

42