CIRS has become a data center.

After intensive analysis carried out during 2015, the second

stage of the project (software design and commissioning)

was turned over to the Credit Bureau of Turkey. In this phase,

which became operational in 2016, information about payment

instruments such as checks, notes, and bills as well as their

collection was also fed into the system. With these additions,

CIRS became a data center which allows invoicees’ payment

performance to be monitored and whose importance to the

country is second only to that of the Banks Association of

Turkey’s Risk Center.

The Department of Revenue Administration’s e‑invoices

have been integrated into CIRS.

Under an agreement between AFI and the Department of

Revenue Administration personal identification-number, tax-

registration number, e‑invoicing obligations, and e‑invoice

verification functions were also linked into CIRS. These

additions have made CIRS an innovative system that provides

2.6 million

documents

In 2016, 2.6 million instances of electronic documents were checked through the Revenue Administration

integration.

Document

Type

Units Average Amount

of Document

Share

(%)

E‑archive

239,559

7,724

4

E‑invoice

2,362,353

29,402

41

Hard copy

3,183,378

20,749

55

General Total

5,785,290

23,743

100

the means for the integrated querying, monitoring, and

reporting of all of the information contained within it.

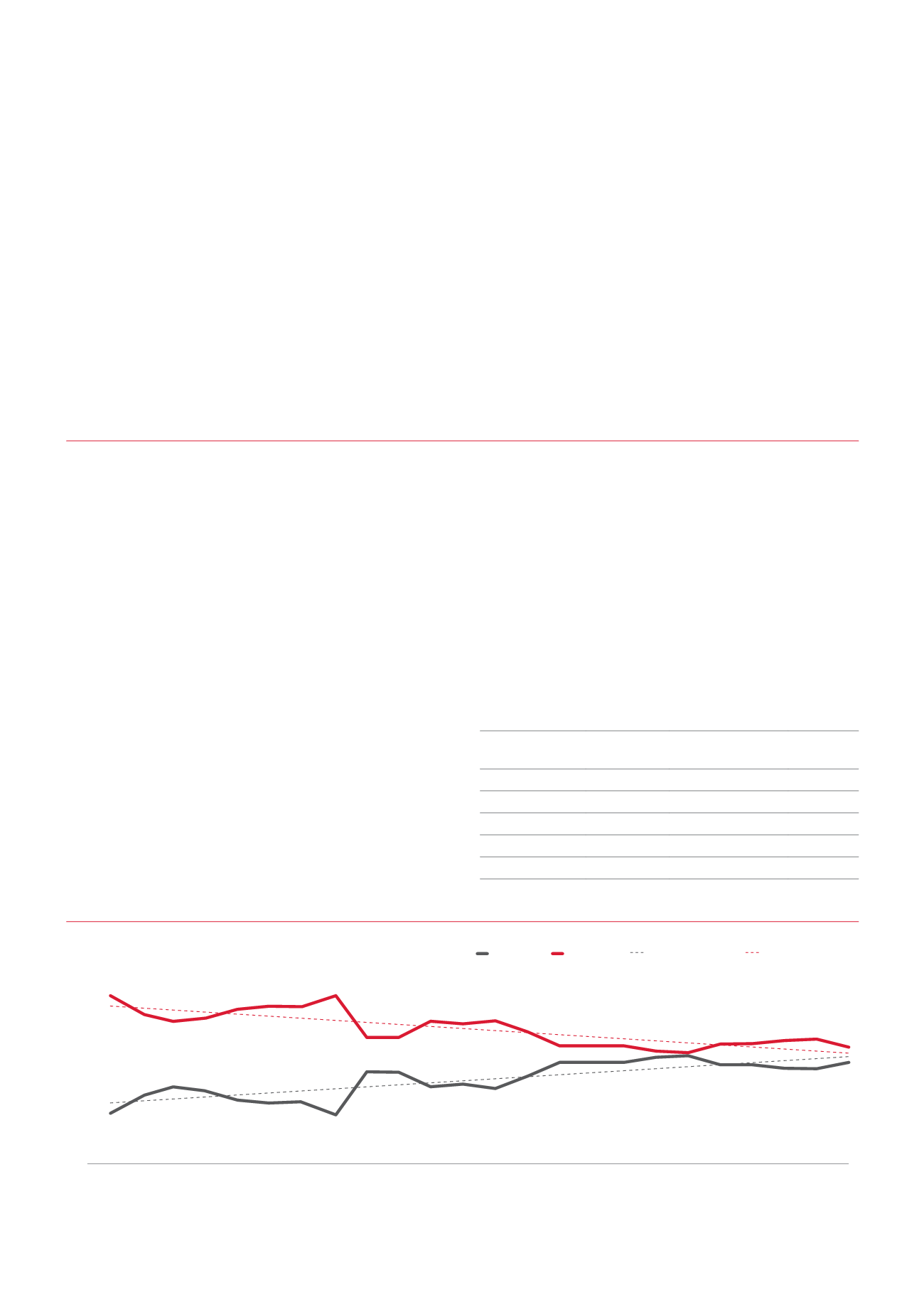

When CIRS first became operational, e‑invoices accounted for

only about 20% or so of the total number of issuances; by the

end of 2016, that had more than doubled to 49% on a monthly

basis. Last year, a total of 5.8 commercial invoices issued by 148

thousand vendors to 355 thousand buyers in 81 provinces were

checked against CIRS. The 2.6 million instances of electronic

documents among that number were checked through the

system’s Revenue Administration links and 868 thousand emails

were sent out to inform CIRS user companies about the results.

Ratios of E‑invoices and Hard Copies

01/2015

01/2016

02/2015

02/2016

03/2015

03/2016

04/2015

04/2016

05/2015

05/2016

06/2015

06/2016

07/2015

07/2016

08/2015

08/2016

09/2015

09/2016

10/2015

10/2016

11/2015

11/2016

12/2015

12/2016

E‑invoice Hard copy Linear (E‑invoice) Linear (Hard copy)

80

70

60

50

40

30

20

10

0

77

77

58 58

54 54

54

54 51 51

55 55 57 57

69

71 72 72

65

65

66

60

64

67

23

23

42 42

46 46

46

46

49 49

45 45 43 43

31

29 28 28

35

35

34

40

36

33

The Association of Financial Institutions

Annual Report 2016

43